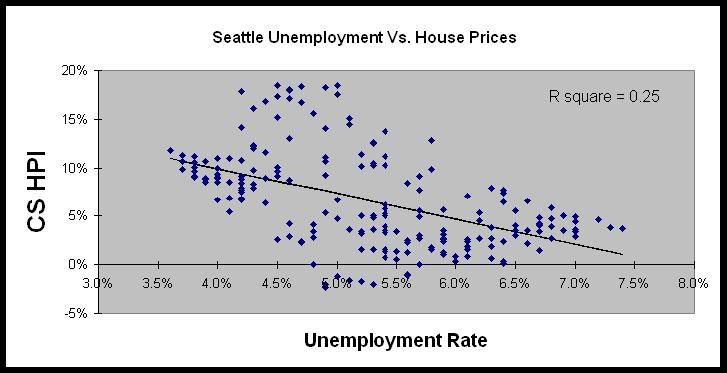

I also ran a simple regression plot (below), which shows a pretty strong inverse relationship between unemployment and housing prices. The R squared is 0.25 and clearly doesn't explain all the variation in home prices, but unemployment's impact is clearly statistically significant (P<.001).

Data used:

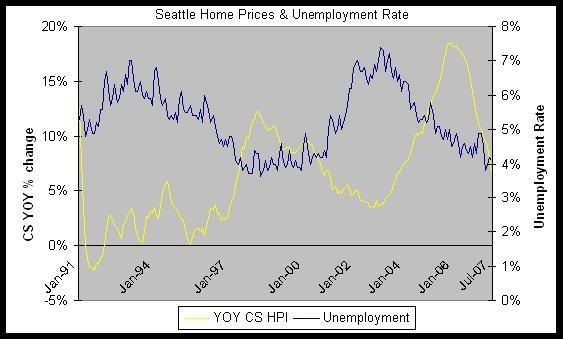

- Housing prices come from Case Shiller HPI and are represented as YOY % changes

- Unemployment is from the BLS website: http://data.bls.gov/cgi-bin/surveymost?la+53