NOTE - This page is a static archive. Visit the current Seattle Bubble forums at SeattleBubble.com/blog/forum/

Good God! We're running out of land sometime after 2022!

Moderators: synthetik, The Tim, Lake Hills Renter

16 posts

• Page 1 of 2 • 1, 2

Good God! We're running out of land sometime after 2022!

Get in now, because prices are gonna skyrocket!

What the heck, NWMLS is publishing an article that suggests any land shortage won't happen until after the boomers start pushing dasies. Someone's gonna get fired.

King County officials say there is "an ample supply" of buildable land to support commercial and residential development for King County's growing population over the next 15 years. In fact, analysts estimate c ities and towns in King County have enough capacity for an additional 277,000 households through 2022, more than twice the remaining residential target of 106,000 households.

http://www.nwmls.com/discover/nwreporte ... ageID=4091

What the heck, NWMLS is publishing an article that suggests any land shortage won't happen until after the boomers start pushing dasies. Someone's gonna get fired.

King County officials say there is "an ample supply" of buildable land to support commercial and residential development for King County's growing population over the next 15 years. In fact, analysts estimate c ities and towns in King County have enough capacity for an additional 277,000 households through 2022, more than twice the remaining residential target of 106,000 households.

http://www.nwmls.com/discover/nwreporte ... ageID=4091

- mike2

- Bubble Bloviator

- Posts: 318

- Joined: Fri Apr 20, 2007 11:01 am

- Location: Not Seattle Anymore

No, it means Seattle is special. NYC, San Francisco, Tokyo, and London may be running out of land, but not Seattle (or Helena, MT for that matter). Therefore, you can expect massive increases in property prices because we are specialer than a hand full of world class cities.

- rose-colored-coolaid

- Bubble Banter Boss

- Posts: 1978

- Joined: Mon Jun 18, 2007 10:26 am

I separate demand into two categories. There is "base demand" created by the need for housing (this includes location sensitive demand created by a desire to have a short or easy commute.) There is also "speculative demand" created by the desire to make money. This includes people who buy to rent out properties and people who buy to flip.

I agree that "base demand" will continue to increase in this area. I think that "base demand" is fairly easy to predict. However, it is not useful in predicting or understanding bubbles.

"Speculative demand" on the other hand behaves quite differently. There are feedback cycles in speculative demand. When "speculative demand" increases it drives prices up. Rising prices encourage more "speculative demand". It makes me think about a . Van der Pol oscillators are non-linear systems with similar feedback loops. They exhibit chaotic behavior and specific trajectories are difficult to predict very far out in the future because they are extremely sensitive to initial conditions.

Using this demand separation and feedback theory does not help predict when bubbles will start or stop. It does predict that bubbles will exist. It can probably be used to identify bubbles if you have a good estimate of base demand.

Much of the analysis done at this site attempts to estimate base demand and growth of base demand to determine if this is a bubble. I'm fairly certain we are in a real estate bubble, but have a contingency plan in case I am wrong.

I agree that "base demand" will continue to increase in this area. I think that "base demand" is fairly easy to predict. However, it is not useful in predicting or understanding bubbles.

"Speculative demand" on the other hand behaves quite differently. There are feedback cycles in speculative demand. When "speculative demand" increases it drives prices up. Rising prices encourage more "speculative demand". It makes me think about a . Van der Pol oscillators are non-linear systems with similar feedback loops. They exhibit chaotic behavior and specific trajectories are difficult to predict very far out in the future because they are extremely sensitive to initial conditions.

Using this demand separation and feedback theory does not help predict when bubbles will start or stop. It does predict that bubbles will exist. It can probably be used to identify bubbles if you have a good estimate of base demand.

Much of the analysis done at this site attempts to estimate base demand and growth of base demand to determine if this is a bubble. I'm fairly certain we are in a real estate bubble, but have a contingency plan in case I am wrong.

- Alan

- Bubble Banter Boss

- Posts: 780

- Joined: Sun Feb 18, 2007 7:08 pm

I agree with your analysis.

It works in reverse too. There is such a thing as negative speculative demand. When negative speculative demand increases it drives prices down. Prices can fall to below fair market prices (a "negative bubble" or "oversold" or whatever we should call it). Falling prices encourage more negative speculative demand, until they don't, and then the negative bubble pops.

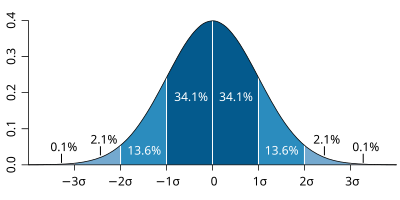

If I was looking to buy when prices are right, I'd keep a very close eye on the market now. House prices are said to be sticky on the way down, but that's in the past not necessarily the future--the maxims of markets are continuously overwritten to maintain their natural chaotic state. Also not all comparable houses are priced the same; their prices tend to fit a bell curve, so that out of any given 30 comparable houses there might be one house that is priced at a steep discount off the average price of the lot. The best time to buy an underpriced house is during a negative bubble, when your competition is on the sidelines waiting for a clear bottom signal that never comes.

It works in reverse too. There is such a thing as negative speculative demand. When negative speculative demand increases it drives prices down. Prices can fall to below fair market prices (a "negative bubble" or "oversold" or whatever we should call it). Falling prices encourage more negative speculative demand, until they don't, and then the negative bubble pops.

If I was looking to buy when prices are right, I'd keep a very close eye on the market now. House prices are said to be sticky on the way down, but that's in the past not necessarily the future--the maxims of markets are continuously overwritten to maintain their natural chaotic state. Also not all comparable houses are priced the same; their prices tend to fit a bell curve, so that out of any given 30 comparable houses there might be one house that is priced at a steep discount off the average price of the lot. The best time to buy an underpriced house is during a negative bubble, when your competition is on the sidelines waiting for a clear bottom signal that never comes.

- Markor

- Bubble Banter Boss

- Posts: 621

- Joined: Sun Jun 17, 2007 11:04 pm

I think the active people on this blog are keeping a close eye on the market. I know I am.

I agree that prices likely fit something like a bell curve. Unfortunately, the houses at the low end do not stay on the market very long. I would even wager that many of the 'good' deals get snapped up by people who invest in RE full-time. I'm planning to shoot for a median deal.

Three months of supply is the equilibrium point from what I've been told.

I agree that prices likely fit something like a bell curve. Unfortunately, the houses at the low end do not stay on the market very long. I would even wager that many of the 'good' deals get snapped up by people who invest in RE full-time. I'm planning to shoot for a median deal.

Three months of supply is the equilibrium point from what I've been told.

- Alan

- Bubble Banter Boss

- Posts: 780

- Joined: Sun Feb 18, 2007 7:08 pm

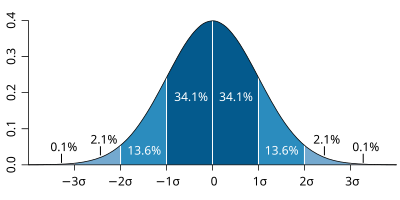

I don't have any numbers on this, but it seems like a poisson distribution is probably a better fit to housing prices (and consumer prices in general) than a normal distribution.

Here's a normal distribution (bell curve)

Here's a poisson distribution

Let's say there's a certain type of house with a median price of $400,000. With a poisson distribution, you might expect to see the cheapest houses listed for $375,000 or so, which the highest priced would list for $500,000. Whereas, with the normal distribution you might see a $500,000 home only if there were a $300,000 comparable (approximately).

Here's a normal distribution (bell curve)

Here's a poisson distribution

Let's say there's a certain type of house with a median price of $400,000. With a poisson distribution, you might expect to see the cheapest houses listed for $375,000 or so, which the highest priced would list for $500,000. Whereas, with the normal distribution you might see a $500,000 home only if there were a $300,000 comparable (approximately).

- rose-colored-coolaid

- Bubble Banter Boss

- Posts: 1978

- Joined: Mon Jun 18, 2007 10:26 am

In my neighborhood all the house values fall between $500K and $700K except for one house worth about $2 million. The prices may well fit a Poisson distribution. But I don't think that tells me which distribution fits comparable houses. I don't see why that wouldn't be a bell curve.

- Markor

- Bubble Banter Boss

- Posts: 621

- Joined: Sun Jun 17, 2007 11:04 pm

It could be a bell curve, but it's good to ask if a bell curve is accurate or not. The normal distribution is frequently over used just because it's so simple (mean + standard deviation = bell curve).

I think what DJO linked shows fairly accurately that total sales prices fits a poisson more closely than a bell curve (obviously neither is all that accurate).

Here's an explanation of why I am asking the question in the first place. Most sellers receive pricing advice from agents, and most also check Zillow. Now let's make (a wild and almost certainly wrong) assumption that both Zillow and a typical agent know what the house should sell for (median price). Some people will hear that price and say 'I can get 10% more than that'. Others will say 'fine lets sell for that'. Very few (any?) will hear that price and say 'sounds too high, let's drop it 10%'. That's my thinking in supporting the poisson distribution.

Of course, we can't trust that Zillow or any agent will be so accurate. Typically, you would assume a Gaussian distribution for inaccuracy. Gaussian distributions produce bell curves, which would support the theory of a normal distribution for housing prices.

Obviously, both models are filled with uncertainty and probably wrong, but they both also seem to contain some truth. But the thing is, if you combine them (assuming they both contribute somewhat to price) what you get out is still more of a poisson distribution than a normal distribution.

I guess this is all pretty esoteric, but I am personally interested in it, because it might help me predict what kinds of real deals to expect.

I think what DJO linked shows fairly accurately that total sales prices fits a poisson more closely than a bell curve (obviously neither is all that accurate).

Here's an explanation of why I am asking the question in the first place. Most sellers receive pricing advice from agents, and most also check Zillow. Now let's make (a wild and almost certainly wrong) assumption that both Zillow and a typical agent know what the house should sell for (median price). Some people will hear that price and say 'I can get 10% more than that'. Others will say 'fine lets sell for that'. Very few (any?) will hear that price and say 'sounds too high, let's drop it 10%'. That's my thinking in supporting the poisson distribution.

Of course, we can't trust that Zillow or any agent will be so accurate. Typically, you would assume a Gaussian distribution for inaccuracy. Gaussian distributions produce bell curves, which would support the theory of a normal distribution for housing prices.

Obviously, both models are filled with uncertainty and probably wrong, but they both also seem to contain some truth. But the thing is, if you combine them (assuming they both contribute somewhat to price) what you get out is still more of a poisson distribution than a normal distribution.

I guess this is all pretty esoteric, but I am personally interested in it, because it might help me predict what kinds of real deals to expect.

- rose-colored-coolaid

- Bubble Banter Boss

- Posts: 1978

- Joined: Mon Jun 18, 2007 10:26 am

16 posts

• Page 1 of 2 • 1, 2

Who is online

Users browsing this forum: No registered users and 60 guests